Business Insurance in and around Beaver Dam

Looking for protection for your business? Search no further than State Farm agent Gina Oemig!

Cover all the bases for your small business

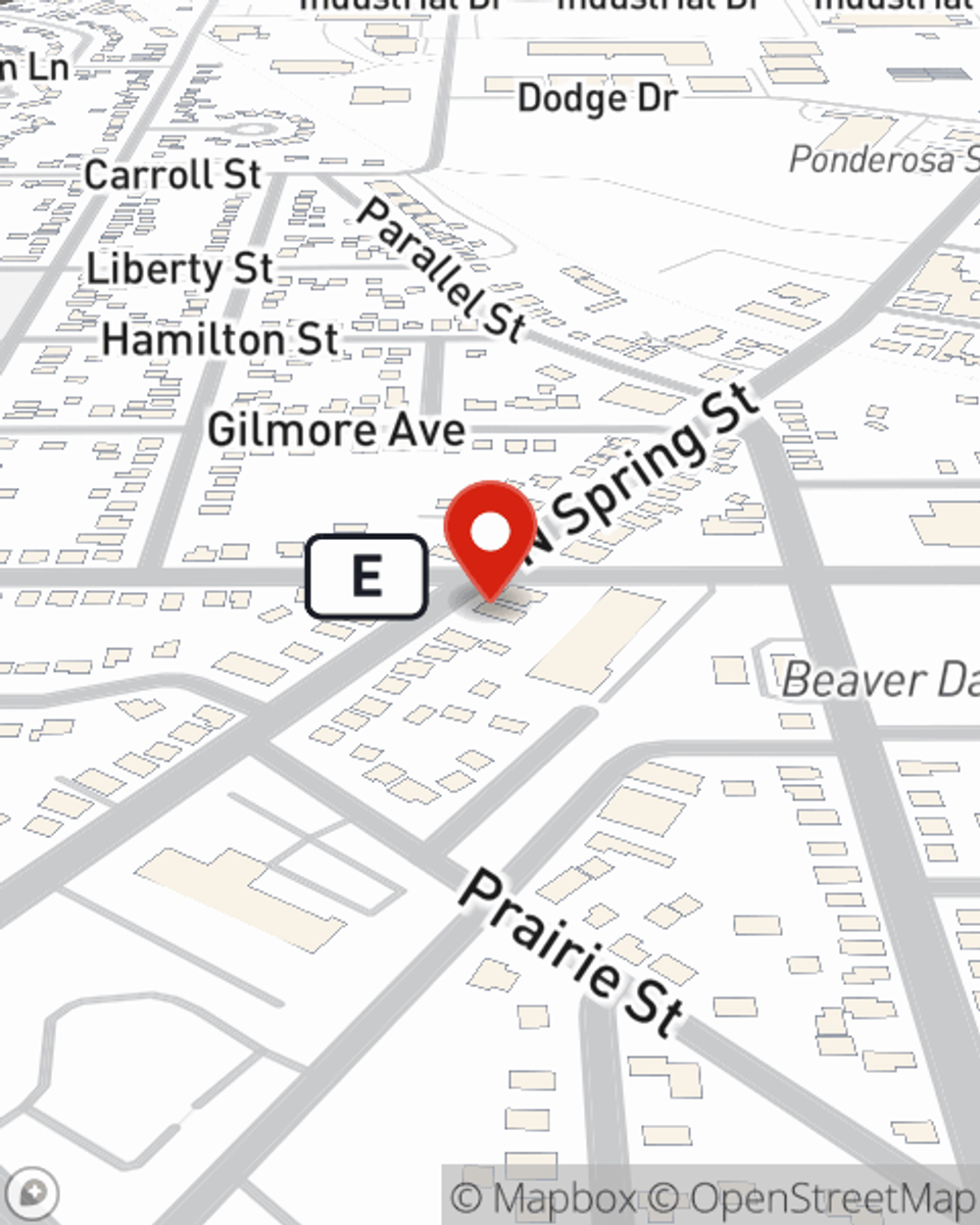

- Wisconsin

- Beaver Dam

- Waupun

- Fox Lake

- Juneau

- Lowell

- Reeseville

- Randolph

- Cambria

- Clyman

- Watertown

- Iron Ridge

- Burnett

- Hustisford

- Markesan

- Waterloo

- Columbus

- Dodge County

- Columbia County

- Green Lake County

- Fond Du Lac County

- Washington County

- Jefferson County

- Dane County

State Farm Understands Small Businesses.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Gina Oemig understands the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to consider.

Looking for protection for your business? Search no further than State Farm agent Gina Oemig!

Cover all the bases for your small business

Cover Your Business Assets

For your small business, whether it's a shoe store, an antique store, a travel agency, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like accounts receivable, buildings you own, and extra expense.

It's time to visit State Farm agent Gina Oemig. You'll quickly notice why State Farm is one of the leaders in small business insurance.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Gina Oemig

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.